37+ how do i change my mortgage provider

Web Final hints and tips. Check with the lenders on your.

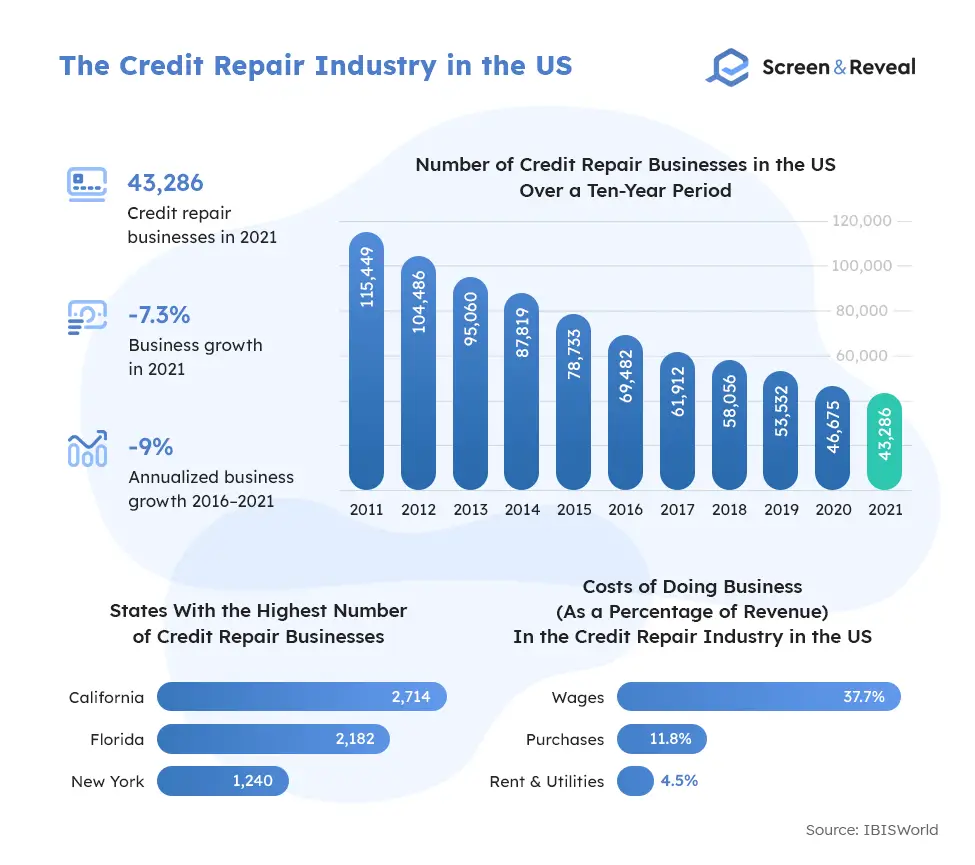

37 Credit Repair Statistics And Facts For 2022 Screen And Reveal

It can save time as the current mortgage lender already has all of your details.

. Remortgaging with the same lender may save you money. Contact a mortgage broker who can advise on the merits of different deals match you with a provider and guide you through the application process. You could lose the house.

Whether youll incur costs or not will depend on the structure of your existing loan and your current lenders policy. Switching mortgage companies before closing could also put you in violation of your contract. Tell you about cheaper options 60 days before your fixed rate mortgage period ends.

Check for fees and extra costs. Web an assignment fee to transfer the mortgage from the old lender to the new lender 25-330 a discharge fee to discharge the old mortgage and register the new mortgage 5-395 and. Web Since 1 January 2019 the Central Bank of Ireland has put new measures in place to make it easier to switch your mortgage.

Web Step 1. Ad Compare the Best Home Loan Lenders for March 2023. Web If your existing provider wont play ball it could be time to consider switching your mortgage to a new provider.

Before you change provider if it is to obtain a cheaper deal than your existing one consider asking your provider about their product transfers before you commit to moving. Lenders often offer to pay some or all of these fees when you switch providers. Delays in the homebuying process could cost you your dream home.

Web You dont have to change mortgage lender if you want to remortgage. Web Knowing the details of your policy your limits deductibles inclusions exclusions and expiration date can help you make an informed decision when changing your provider. Apply Get Pre-Approved Today.

Get in touch with a mortgage broker Between three and six months before your current mortgage offer expires get in touch with an independent mortgage broker such as our partners London and Country or Fluent. Web Often the initial rate you pay for a mortgage is set for a period of time that once expired reverts to the mortgage providers SVRThe exact period of the initial rate will vary depending on the deal for example a two-year fixed mortgage rate will either last for two years from the date you take out the mortgage or on a date of two years or more set. The Search For The Best Mortgage Lender Ends Today.

Theres a few situations where its best to stay put or at least wait until the timing is right. The calculation is usually conducted on the basis of having an interest only mortgage. Web Heres what to expect from the process of switching your mortgage from one provider to another.

Keep in mind just because a company services a loan today doesnt mean theyll continue to do so long term. Compare Apply Get The Lowest Rates. Web If you have a mortgage you will need to keep your lender in the loop.

View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes. You can simply switch deals with your current provider known as a mortgage transfer which is usually quicker and less hassle. Web Up to 25 cash back After you start sending your mortgage payments to the new servicer you should monitor at least two payments to make sure the new servicer is correctly applying them to your mortgage loan account.

Your mortgage servicer may transfer the mortgage servicing rights for your loan to another company to service your loan. While changing your bank may seem daunting it doesnt have to be a difficult process your new lender should be able to do most of the legwork for you. Look for this information in your policy.

The early repayment fee is high. If you have an ongoing mortgage loan your lender may have requirements for insurance coverage that your new policy must meet. Exit fees and charges from your current lender.

The industry is always changing. Web For example if you wanted wanted to borrow 100000 on a buy to let mortgage then rental income must cover the mortgage payments by at least 125 at a nominal interest rate of 6. Web How Do I Switch Mortgage Providers.

Web Well help make it as easy as possible on your wallet but you should consider. Web When youve found the mortgage you want to switch to you can either apply directly to the lender or get a broker to do it for you. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Some lenders may not require an additional credit check as you have a proven track record. Ad Check Out Army National Guard Home Loan Benefits Today. It may be easier to get your remortgage approved.

This works out to be a monthly payment of 500 meaning the rental income. Join the Army National Guard and Find Home Loan Benefits that Suit You. Youll need to ask your current lender for a redemption statement which shows how much you owe on your existing mortgage along with any charges youll be liable for.

If you pay for your homeowners insurance directly call your lender to notify it you have switched insurance. Check what your existing. Youll probably be required to pay closing costs on a new home loan.

Web The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Web Yes its possible to change your terms in a number of ways when you remortgage for example you might want to switch from an interest-only to a repayment mortgage from a fixed-rate to a. Please talk to us about this.

Legal fees for your lawyer to sign the new mortgage agreement 1500. Do the math to prevent losing any. Notify you if you are on a variable rate but not a tracker if you can move to a cheaper rate due to a change in your loan-to-value.

Savings could be negated by closing costs. Inspect your current policy Youll need to know your annual premium coverage and deductible so you can compare it to similar policies. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Ad Highest Satisfaction for Mortgage Origination. Web Your servicer can change. Web Remortgaging with the same lender - the pros.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. If your mortgage servicing rights are transferred to a new servicer you will need to start sending your monthly payments to the new servicer after a certain date. Apply Now To Enjoy Great Service.

Homes Land Of The Smokies Vol 37 Issue 2 By Homes Land Of Tennessee Issuu

Can You Change Your Mortgage Provider

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Kenny Idstein Sr Loan Officer Fairway Independent Mortgage Corporation Linkedin

Questions To Ask A Mortgage Lender

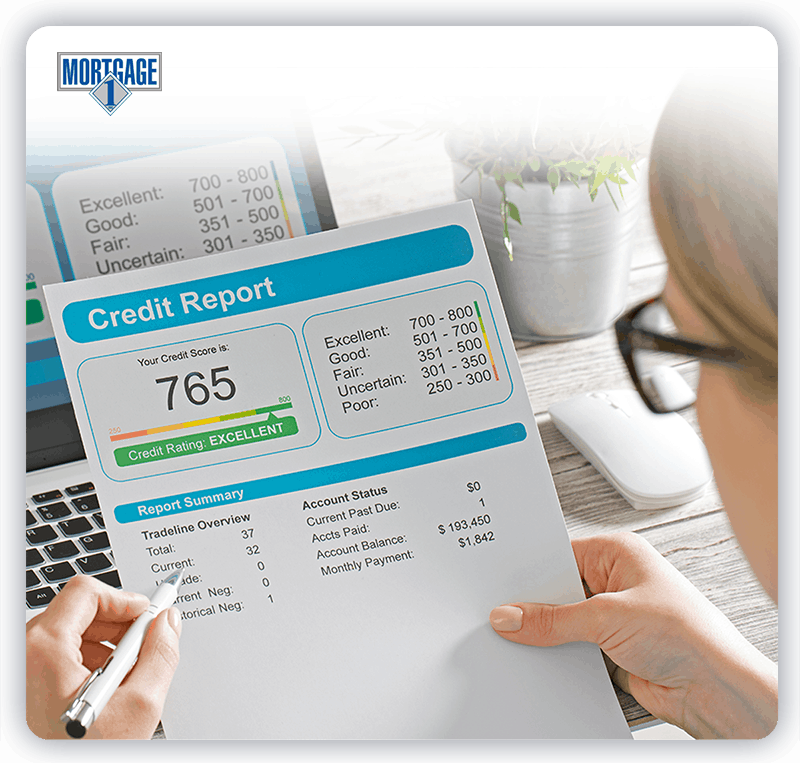

10 Steps Toward Home Ownership Mortgage 1 Inc

Switch Your Mortgage Provider Uswitch

36 Elm Avenue Larkspur Ca 94939 Compass

How To Avoid Mortgage Default Hgtv

Switch Your Mortgage Provider Uswitch

How To Change Your Mortgage Lender Rocket Mortgage

How To Switch Mortgage Deal Switching Rates Hsbc Uk

Selling A House With A Reverse Mortgage What To Know

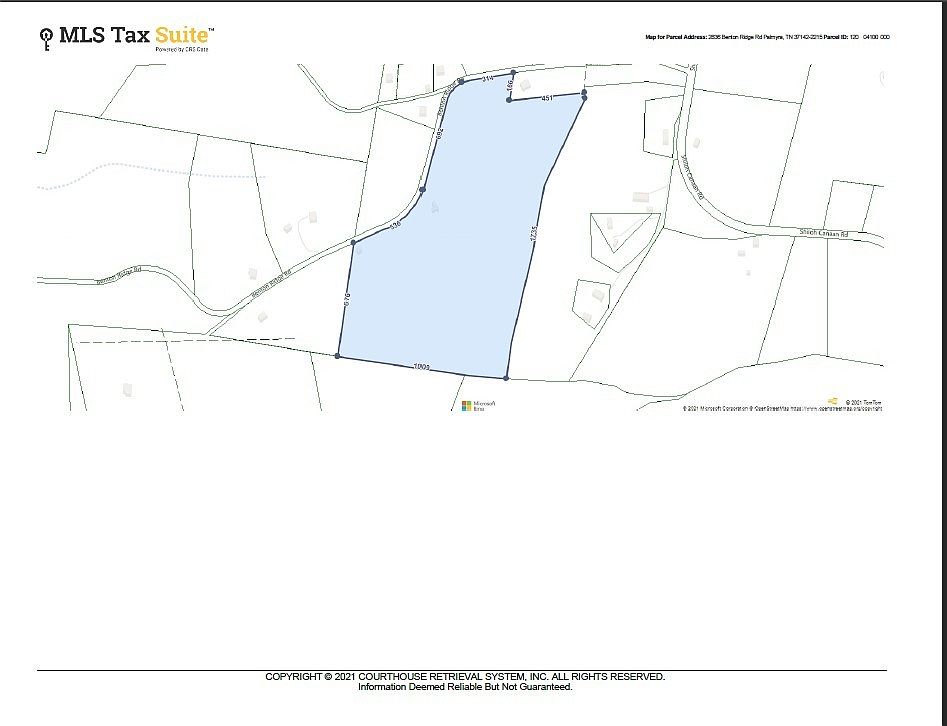

2836 Benton Ridge Rd Palmyra Tn 37142 Mls 2276233 Zillow

Switch Your Mortgage Provider Uswitch

Term Of A Mortgage Which Length Is Best

Busorgs Chasalow Outline Flowcharts Pdf Law Of Agency Partnership